Table Of Content

There are also optional inputs within the calculator for annual percentage increases under "More Options." Using these can result in more accurate calculations. An FHA loan is government-backed, insured by the Federal Housing Administration. FHA loans have looser requirements around credit scores and allow for low down payments. An FHA loan will come with mandatory mortgage insurance for the life of the loan. Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

Use our home equity loan calculator to find a rate and monthly payment that fits your budget.

To remedy this situation, the government created the Federal Housing Administration (FHA) and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards. When a loan exceeds a certain amount (the conforming loan limit), it's not insured by the Federal government. Loan limits change annually and are specific to the local market. Jumbo loans allow you to purchase more expensive properties but often require 20% down, which can cost more than $100,000 at closing.

Closing Costs

Your debt-to-income ratio (DTI) refers to the percentage of your monthly income that goes toward paying off debt. Since lenders look at DTI to make lending decisions, having a high DTI can keep you from qualifying for other loans in the future. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator.

Mortgage Calculators

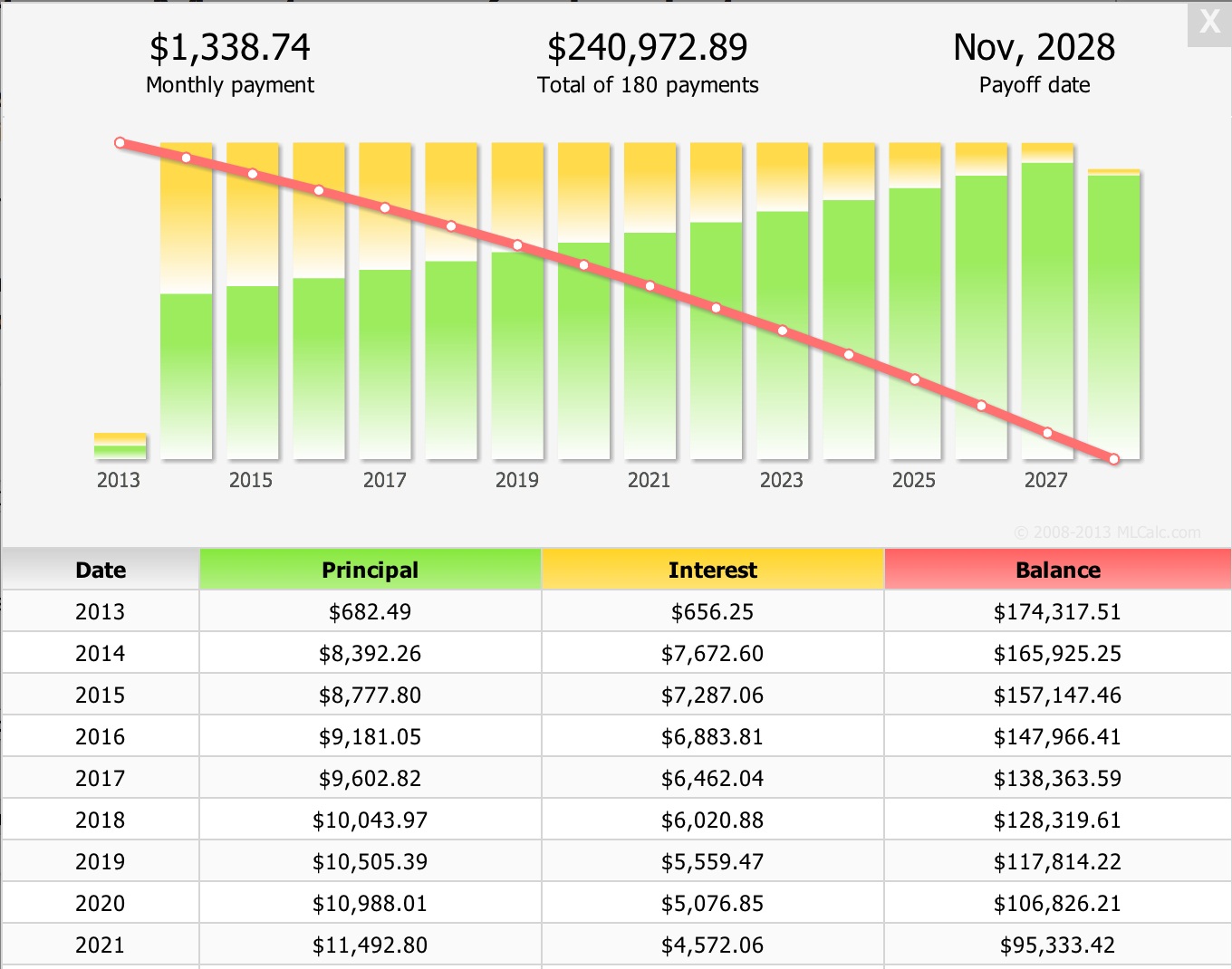

The amortization chart shows the trend between interest paid and principal paid in comparison to the remaining loan balance. Based on the details provided in the amortization calculator above, over 30 years you’ll pay $351,086 in principal and interest. Jumbo loans are used to secure luxury homes and houses in high-cost areas.

NerdWallet’s mortgage payment calculator makes it easy to compare common loan types to see how each type of loan affects your monthly payment. We source the latest weekly national average interest rate from Zillow, so you can accurately estimate and compare your monthly payment for a 30-year fixed, 15-year fixed, and 5/1 ARM. Lenders look most favorably on debt-to-income ratios of 36% or less — or a maximum of $1,800 a month on an income of $5,000 a month before taxes. Lock in low rates currently available and save for years to come! If you secure a fixed mortgage rate your payments won't be impacted by future rate hikes.

How will interest rates affect your home loan?

This shortens their payment duration and helps them save thousands on interest costs. Also called jumbo mortgages, non-conforming conventional loans exceed the conforming limits set by the FHFA. These loans surpass the financing limits followed by Freddie Mac and Fannie Mae. Jumbo mortgages are commonly obtained to purchase luxury houses in high-cost locations. These loans are provided by private lenders such as banks, credit unions, and non-bank mortgage institutions.

Get a more accurate estimate

A 30-year mortgage will have the lowest monthly payment amount but usually carries the highest interest rate—which means you’ll pay much more over the life of the loan. A 15-year mortgage will have a higher monthly payment but a lower interest rate than a 30-year mortgage. Because you pay more toward the principal amount each month, you’ll build equity in your home faster, be out of debt sooner, and save thousands of dollars in interest payments. In addition to there being multiple mortgage terms, there are several common types of mortgages. Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Amortization schedule

As long as you make consistent payments, your debt should be paid off within 30 years.On the other hand, adjustable-rate mortgages are loan options with an introductory rate. It starts off with a low interest rate during the introductory period, after which the rates adjusts every year according to the market index. ARMs come in different terms, such as 3/1 ARM, 5/1 ARM, 7/1 ARM, and 10/1 ARM. To calculate your DTI, add all your monthly debt payments, such as credit card debt, student loans, alimony or child support, auto loans and projected mortgage payments.

Add All Fixed Costs and Variables to Get Your Monthly Amount

Fixed-rate loans, in particular, typically offer slightly higher rates compared to adjustable rate mortgages. A 15-year loan does come with a higher monthly payment, so you may need to adjust your home-buying budget to get your mortgage payment down to 25% or less of your monthly income. Use our mortgage calculator to get an idea of your monthly payment by adjusting the interest rate, down payment, home price and more.

Change the home price in the loan calculator to see if going under or above the asking price still fits within your budget. If you’re ready to get prequalified for a mortgage loan, we recommend talking with Churchill Mortgage. A reverse mortgage is when a homeowner borrows against their home, though they must have built up significant equity in their homes. The borrower must be at least 62 years old so they may not necessarily repay the loan back. When the borrower moves or dies, the proceeds from selling the property are used to pay off the loan. While a mortgage calculator is best for those looking to buy a home, it can also be used when refinancing your home or paying off a mortgage early.

Adding different information to the mortgage calculator will show you how your monthly payment changes. Feel free to try out different down payment amounts, loan terms, interest rates and so on to see your options. Typically, when you belong to a homeowners association, the dues are billed directly, and it's not added to the monthly mortgage payment. Because HOA dues can be easy to forget, they're included in NerdWallet's mortgage calculator. Bankrate's calculator also estimates property taxes, homeowners insurance and homeowners association fees.

Arkansas Mortgage Calculator - The Motley Fool

Arkansas Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

To calculate amortization with an extra payment, simply add the extra payment to the principal payment for the month that the extra payment was made. Any additional extra payments throughout the loan term should be applied in the same way. Keep in mind, while you can pay off your principal early, in some cases there may be a pre-payment penalty for paying the loan off too early. These loans are specifically granted to active military members, veterans, and qualified military spouses. It comes with flexible qualifying standards and a zero downpayment option.

To give you a better idea, let’s say the conforming limit for a 2-unit house in your area is $702,000. If you took a mortgage at $500,000 for a 2-unit home, it is considered a conforming loan. However, if you exceed the $702,000 loan limit, your mortgage will classified as a non-conforming conventional loan. Simply enter your email to get monthly content that’ll help you navigate the market with confidence.

There are a variety of low-down-payment options available for home buyers. You may be able to buy a home with as little as 3% down, although there are some loan programs (such as VA loans and USDA loans) that require no money down. If you’re hoping to buy a home, weeks or months could pass before you find a house and negotiate your way to an accepted offer. But mortgage pre-approval does not last indefinitely, since your financial circumstances could change by the time you close your real estate deal.

She explained that some people will be very specific with their desires, like selecting a photo of the exact car they want, or the perfect house, but that isn't how manifestation works. There needs to be an element of trust in the universe giving them what they attract. But some courses have popped up online which cost more than £1,000. "It's happened on so many occasions, like four, five times," he said.

No comments:

Post a Comment